Coinbase New Tax Dashboard Helps Users Report Crypto Gains

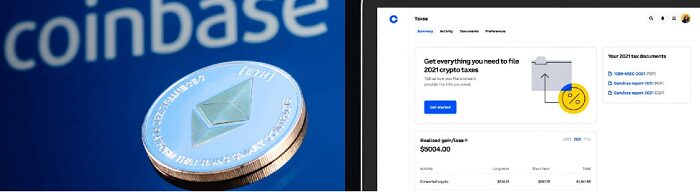

Coinbase, a prominent site for buying and trading cryptocurrencies, has released a new tax dashboard that allows customers to track their profits and losses more easily. The dashboard is designed to assist customers when it comes time to report their crypto-asset activity to the IRS, while Coinbase states that it does not report gain or loss details to the IRS.

The average person perceives Bitcoin similarly to money, but the IRS has a different perspective. Bitcoin and other digital cryptocurrencies are deemed property by the taxation office, which means users must record their gains and losses when paying their annual taxes. Meanwhile, tracking that data can be tricky, and previous exchanges haven’t helped the situation.

With its newly launched tax dashboard, Coinbase hopes to change that. Though the data may not be comprehensive when it comes to reporting your crypto assets to the IRS, it would provide a glimpse of the transactions as well as valuation changes that happen through your Coinbase account, which is a good start.

Viewing the tax dashboard on Coinbase

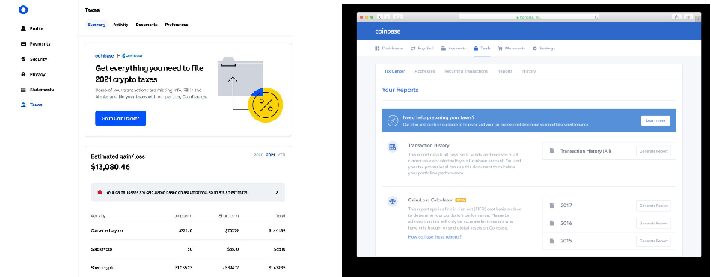

The tax dashboard is available to Coinbase users via the platform’s application or website. On the website, users can pick “Taxes” from the taking menu by clicking their profile image in the upper right corner of the display. Users must touch Profile & Settings in the application to access the menu featuring the tax dashboard link.

The tax dashboard shows a summary of transactions done with that Coinbase account over the preceding year, including crypto assets transferred from one digital coin to another, the amount of crypto sold, the amount of crypto spent, and any “advanced trading” activities.

The dashboard also calculates an anticipated loss or gain based on the transactions, however, Coinbase emphasizes that the figure is “derived based on assumptions.” Users are also given information on “miscellaneous income,” which includes transactions based on rewards and interest.

Some users are allowed to download a 1099-MISC form if they received earnings from incentives or staking. If the account earned at least $600 in cryptocurrencies in the preceding year, this taxation form is sent to both the user and the IRS.

CoinTracker will give a tax report with up to 3,000 crypto transactions for free, which is recommended for crypto aficionados who have done several transactions, including receiving crypto from external wallets.

Conclusion

Coinbase, a prominent site for buying and trading cryptocurrencies, has released a new tax dashboard that allows customers to track their profits and losses more easily. The dashboard is designed to assist customers when it comes time to report their crypto-asset activity to the IRS, while Coinbase states that it does not report gain or loss information to the IRS.

- How To Buy And Sell Bitcoin In India- A Comprehensive Report

- The Game of 8 Fake Crypto Apps: Making Extra Payments by Luring Them

- India’s First Cryptocurrency Index IC15 Launched: How It Works, What It Means For Investors

With its newly launched tax dashboard, Coinbase hopes to change that. Though the data may not be comprehensive when it comes to reporting your crypto holdings to the IRS, it would provide a glimpse of the transactions as well as valuation changes that have occurred through your Coinbase account, which is a good start.

People May Ask

Q- What are my cryptocurrency tax requirements for the year 2021?

A- In the United States, there are two sorts of crypto taxes: capital gains and income taxes.

Q- Where can I download my transaction history?

A- You may download your transaction history from Coinbase.com’s Reports area, and you can download Pro transactions from the Statements part of Pro.

Coinbase proposes connecting your account to CoinTracker to assess your annual gains/losses and set a cost basis for your transactions. Find out more about CoinTracker.

Q- Is Form 1099-K available from Coinbase?

A- For the tax year 2021, we will not issue a Form 1099-K for Coinbase trades.

Q- Is Form 1099-B available from Coinbase?

A- Form 1099-B is not issued by Coinbase.

Q- Is it possible for cryptocurrency donations to be tax-deductible?

A- Cryptocurrency donations to charity may be tax-deductible. Please get advice from a tax professional on your specific tax situation.

Q- What is the tax treatment of trading fees?

A- Trading costs are deducted from your proceeds and are reflected in your cost basis (the price you paid for your cryptocurrency) (what you earn from selling or trading).

Q- Is it possible to get tax forms for international customers?

A- We do not currently provide tax forms to international customers. Please use your transaction history to complete any required local tax filings.