How To File Income Tax Return, FY 2021-22 (AY 2022-23)

- Income Tax

- Why Is It Necessary To File Income Tax Return?

- Benefits Of Filing ITR

- How To Get Income Tax Return Copy Online ?

In 2022, how to file income tax return or how to fill ITR via the IRS’s online portal. An income tax return is a document that a person uses to record his or her earnings, spending, tax deductions, investments, and taxes, among other things.

The Income Tax Act of 1961 makes it essential for a taxpayer to file an income tax return in a variety of situations.

An income tax return is a document used to report a taxpayer’s annual earnings. Even if there is no income, there are a variety of reasons to file an income tax return.

A taxpayer may need to file an income tax return to declare his earnings for the year, carry forward losses, claim an income tax refund, or claim tax deductions, among other things.

The Income Tax Department offers the option of filing an income tax return electronically (e-filing). Before going over the steps required in e-filing an income tax return, it’s critical for a taxpayer to preserve all of the necessary documentation for ITR calculation and reporting.

Income Tax

Income tax is a type of direct tax that is levied on your earnings. It means that the government receives a percentage of your earnings.

This money is used by the government to pay for things like health care, education, agriculture subsidies, and infrastructure. It is paid by an individual, a HUF, or any taxpayer based on their income or gains over the course of a financial year.

No matter how much money a firm makes, it must pay income tax. From time to time, the government enacts legislation that sets the tax rate on your earnings.

Why Is It Necessary To File Income Tax Return?

Individuals must file returns only if their income exceeds the basic exemption limit or if they meet certain criteria, such as spending more than Rs 2 lakh on foreign travel and using more than Rs 1 lakh on electricity, and depositing an amount/aggregate of more than Rs 1 crore in one or more current accounts in FY 2019-20 or later.

If a resident’s asset is located outside of India or if he or she has signing authority over an account that is based outside of India. Even if you are not qualified for the benefits, it is still a good idea to file your ITR.

Benefits Of Filing ITR

- ITR filing generates a valid evidence of income.

- ITR is necessary for future loan applications.

- ITR is required by banks even for credit card applications.

- ITR is required for VISA applications, and so on.

- As a result, even if your income is below the basic exemption ceiling, you need file an ITR.

How To File Income Tax Return

Here are steps , how to file ITR:

Step 1: Calculation of Income and Tax

The taxpayer will be obliged to compute his or her income in accordance with the rules of the income tax legislation that apply to him or her.

The computation should include all sources of income, including salary, freelancing, and interest income. Tax-saving investments, for example, can be claimed as deductions under section 80C.

A taxpayer should also consider any credit for TDS, TCS, or any advance tax paid.

Step 2: Tax Deducted at Source (TDS) Certificates and Form 26AS

The taxpayer should total his TDS amount based on the TDS certificates he has received for each of the four quarters of the fiscal year. Form 26AS provides a summary of TDS and tax paid during the fiscal year to the taxpayer.

Step 3: Choose the right Income Tax Form

The taxpayer must determine which income tax form/ITR Form he should use to file his income tax return.

The taxpayer can proceed with the filing of the income tax return after determining the income tax form. Filing can be done in two ways: online or offline.

The online mode is only available for ITR 1 and ITR 4 via the taxpayer’s login; it is not available for forms from other categories of individual taxpayers.

For all types of income tax forms, the offline mode (creating XML and uploading) is available.

Step 4: Download ITR utility from Income Tax Portal

Go to www.incometax.gov.in and select “Downloads” from the top menu bar. Select the assessment year and download the offline utility programme, such as Microsoft Excel, Java, or JSON, depending on your preference. From AY 2020-21, the income tax department will stop using the excel and java utilities.

Step 5: Fill in your details in the Downloaded File

Fill in the required details of your income after downloading the offline utility, and check the tax payable or refund recoverable based on the utility’s calculations. The downloaded form can be filled up with the details of an income tax challan.

Step 6: Validate the Information Entered

On the right-hand side of the downloaded form, there are a few buttons. To check that all of the needed information is filled in, click the ‘Validate’ button.

Step 7: Convert the file to XML Format

After confirming the file, click the ‘Generate XML’ button on the right-hand side of the file to convert it to XML format.

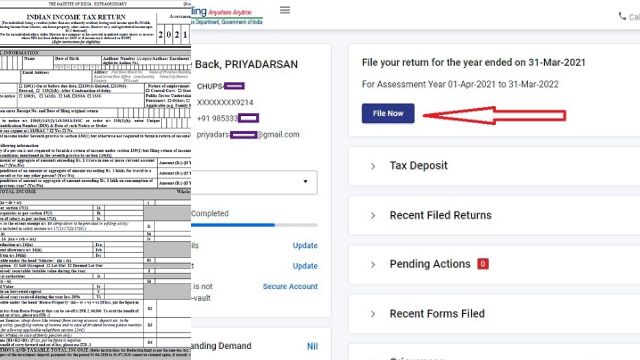

Step 8: Upload the XML file on the Income Tax Portal

Log in to the income tax e-filing portal and select the ‘Income Tax Return’ option under the ‘e-File’ menu. Provide the required information, including your PAN, assessment year, ITR form number, and submission mode. Remember to select ‘Upload XML’ from the drop-down menu next to the ‘Submission Mode’ field.

Now, click the ‘Submit’ button and attach the XML file from your PC.

Choose either Aadhaar OTP, electronic verification code (EVC), or mailing a physically signed copy of ITR-V to CPC, Bengaluru.

Read Also: How To Download Form 16 For Income Tax Returns

How To Save Income Tax?

Tax planning can help you save money on your taxes in a variety of ways. The Income Tax Act allows you to claim numerous deductions and exemptions that will lower your total taxable income and lower your tax bill. Some of the most prevalent deductions and exemptions are listed below:

- Deduction up to Rs 1.5 lakh under 80C – Investment in tax saving options like 80 C- investing in ELSS , LIC, mutual funds, deduction for tuition fees for children, deduction for principal amount of home loan, etc.

- Additional deduction of Rs 50,000 above Rs 1.5 lakh in 80 CCC (1b) for contribution towards National pension schemes of the central government.

- 80D allows deduction of medical insurance premium paid for self, spouse , children (Rs 25000 / 50,000 ) and dependent parents ( Rs 25000 / 50,000).

- 80G allows deduction for donation made to recognized institutions and trusts as per specified limits.

- House rent allowance exemption allowed partially or fully under 10 (13A).

- Deduction for higher education loan under 80E.

- Deduction for a house loan paid under section 24 up to 2 lakhs for a self-occupied property and the entire amount if the property is rented.

How To Get Income Tax Return Copy Online ?

- Use your credentials to access incometaxindiaefiling.com.

- Click on View Returns/ Forms, then select “Income tax returns” and the appropriate assessment year, then click Submit.

- A window will appear with a list of ITRs that have been filed.

- When you click on the ITR-V acknowledgement number you want to obtain, a PDF version of the ITR V will open, which you can download.

Conclusion

Keeping the Internal Revenue Service updated about your earnings and taxability will maintain you just on right side of the law and avoid any financial roadblocks. Now that you understand whether or not you are required to file an ITR, you must ensure that you finish the process each year before the deadline.

Q- What documents are needed to file an ITR?

- PAN Card is a government-issued identification card. If you’re filing an income tax return, this is the first and most important requirement.

- Aadhar Card is a unique identification card issued by the government of India.

- Form 16.

- Forms 16A, 16B, and 16C.

- Bank Account Information.

- Home Loan Statement.

- Tax Saving Instruments.

- Form 26AS.

Q- Is there a minimum income requirement to submit an ITR?

A- Any individual whose income above Rs 2.5 lakh (for FY 2020-21) is required to file an income tax return in India, whether they are a resident or not.

Q- Who qualifies to file an ITR?

A- Individuals whose taxable income surpasses the tax-free threshold are required to file an income tax return. For the fiscal year 2019-20, the basic exemption ceiling is Rs 3 lakh for senior people (aged 60 to 80), Rs 5 lakh for super senior citizens (aged 80 years or more), and Rs 2.5 lakh for others.

Q- Is it possible to file an ITR without a bank account?

A- You cannot, despite the fact that the Income Tax Act does not require you to have a bank account. You cannot now file an online return without mentioning at least one bank account number due to administrative mechanisms and algorithms.

Q- What types of income are tax-free?

A- Individuals whose total income during the financial year exceed the exemption level of more than the gross total income of $250,000 must file income tax returns, according to income tax legislation.