How To Download GST Certificate

How to download GST certificate? A GST registration certificate is a legal document that proves that a business is registered for GST in India.

Any company in India with income that exceeds the GST registration threshold must register. Certain businesses, such as casual taxpayers, non-resident taxpayers, and others, must register with the GST.

GST Certificate Download

Businesses in India must obtain a GST certificate if their revenue exceeds a certain threshold. This certificate must be displayed on a company’s premises.

Otherwise, it will be subject to the penalties of the Goods and Services Act.

Any business can apply for a GST certificate on the Goods and Services Tax website, gst.gov.in. It’s also worth noting that tangible certificates aren’t provided by the government.

The certificate can be downloaded solely through the GST website. A GST certificate is given to every taxpayer who successfully registers for GST.

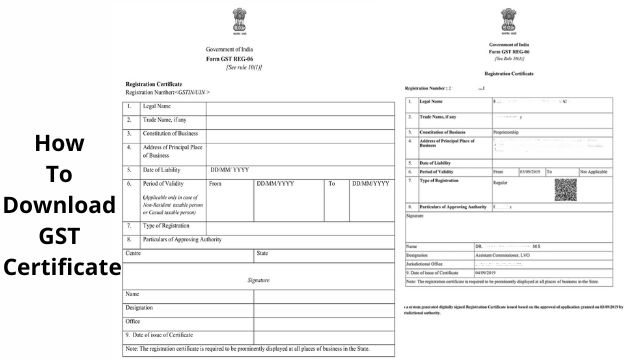

A GST registration certificate in the form GST REG-06 is issued to every GST-registered taxpayer. Among the various types of taxpayers are ordinary, TDS, and TCS GST applicants, those associated with acquiring a unique ID under Section 25 (9) of the CGST Act, non-residents, which include OIDAR (Online Information Database Access and Retrieval) network operators, and foreigner taxpayers under pre-GST rules.

The certificate has no expiration date when given to ordinary taxpayers. GST registrations are valid as long as they are current and have not been cancelled.

(Certificate of registration) A casual taxable taxpayer’s GST registration is valid for ninety days under this statute. The GST registration certificate becomes null and void after that. A taxpayer, on the other hand, has the option of requesting another extension.

How to Download GST Certificate Online

In India, a GST Certificate is required for all types of enterprises. You must have a GST Certificate if you are conducting any form of business, and you must show the GST registration certificate at your place of business.

It’s simple to obtain a GSTIN registration certificate. In this article, we’ll go over how to get GST certificate from the government’s official website.

Steps To Download GST Certificate Online?

To obtain a copy of your GST registration certificate, go to the GST portal’s official website. We’ve outlined all of the steps for download GST registration certificate in this article.

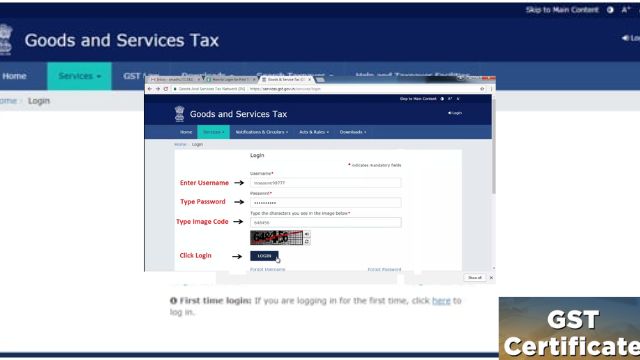

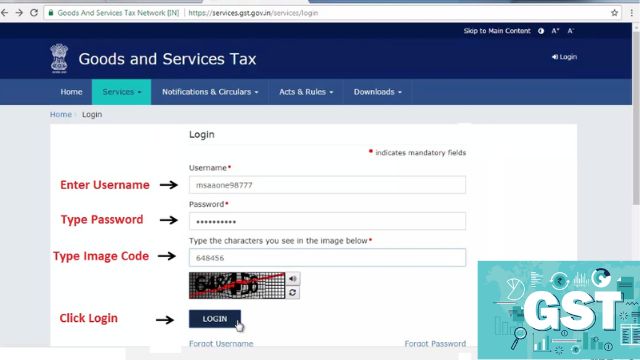

- https://www.gst.gov.in/ is the official GST website.

- Then you must use your credentials to log into the portal.

- To “Login,” you must first provide your “Username and Password.”

- Then select Services –> User Services –> View/ Download Certificate from the drop-down menu.

- To download the certificate, go to the ‘Download’ option on the screen. The certificate will include all of your tax information.

GST Certificate Usage

Every GST-registered taxpayer in India will receive a GST registration certificate in the form of GST REG-06. The GST certificate can be simply downloaded from the GST portal. The GST certificate is not printed; instead, you must download it and print it.

GST Certificate Importance

This certificate must be shown at the person’s primary place of business if he is paying taxes. Also included in the Form GST REG-06 is other GST-related information.

This is a CGST Rule 18 that requires the GST-related information to be displayed at the business location. If a person does to follow this rule, the owner is liable for a Rs 25,000 penalty.

The good news is that the certificate will remain valid for a long period if the owner has not relinquished or cancelled the GST certificate.

The GST certificate will be valid for a maximum of ninety days for casual taxpayers, after which it would become invalid. The taxpayer, on the other hand, has the option of extending the certificate’s validity.

The taxpayer, on the other hand, can get a new GST certificate via the portal. The main certificate, as well as Annexures A and B, comprise the GST registration certificate.

Issues GST Certificate

- The company’s legal name is

- The type of registration is based on the business’s trade name.

- The main place of business

- The company’s other locations

Things Included in the GST Registration Certificate

The main certificate, as well as Annexures A and B, comprise the GST registration certificate.

The major GST registration certificate’s contents are as follows:

- Trade Name and Legal Name of the Taxpayer’s GSTIN

- The Principal Place of Business’s Address

- Liability Start Date

- Types of Business Structure (Eg: Partnership, Company, Proprietorship, Trust, etc)

- Registration Types

- Name, designation, jurisdictional office, and signature of the approving authority (usually digitally signed).

- Validation Period ‘From date’ is usually given with a date. Regular taxpayers, on the other hand, will not see a date for ‘To date.’

Time Validity For GST Registration Certificate

Regular taxpayers who pay their taxes on time are awarded a GST registration certificate. If the registration has not been relinquished or cancelled by the GST authorities, anyone can download the GST certificate. The certificate will be valid for another year.

The validity is strictly limited to a maximum of 90 days for those tax individuals who are not paying their casual taxes in the GST site or non-resident taxable persons.

The taxpayer, on the other hand, has the option of extending the validity of his or her GST certificate or renewing it at the end of the validity period.

Read Also: How To File Income Tax Return, FY 2021-22 (AY 2022-23)

Changes in GST Registration

If you made a mistake when registering for GST or if your certificate was incorrect. Then, using an online GST portal, you can make adjustments to the certificate.

The changes to the core will be approved by tax officials, and once approved, a new GST registration certificate will be sent to you, which you may readily download. The adjustments you can make on the official portal are as follows:-

- Any change in the business’s legal/trade name that does not result in a change in the PAN’s principal place of operation

- Additional Business Location (Other than the change in State)

- Addition or deletion of Partners/Karta/Managing Directors and full-time Directors / Members of Associations’ Managing Committees / Boards of Trustees / Chief Executive Officer or equivalent positions, etc.

Process To Make Changes

- To begin, go to the GST’s official website.

- Use your credentials to log in.

- Then select Services> Registration > Modification of Registration Core Fields from the drop-down menu.

- Then Make the necessary adjustments to the fields.

- Then, to be verified, go to the verification tab.

- From the drop-down menu, choose the Authorized Signatory.

- The location is entered in the “name of the place” field.

- You must digitally sign the application after filling in all of the details using the Digital Signature Certificate (DSC)/ E-signature or EVC.

- Following that, you will be notified via SMS and e-mail about the status of your application, whether it has been approved or rejected.

Conclusion

A GST registration certificate on Form GST REG-06 is supplied to every taxpayer who has successfully registered under GST. It includes the GST Identification Number (GSTIN), as well as the primary and secondary locations of business. The registration certificate is only accessible for download on the GST Portal, and no physical certificates are issued by the government.

Q- What is the procedure for verifying a GST registration certificate?

A- To get started, go to the GST Portal. To discover more, go to the GST Portal. Enter your GSTIN. Fill in the CAPTCHA and the GSTIN number of the supplier or customer in the provided space. The status of your GST registration application can be found here.

Q- What are the three different types of GST?

- The Central Products and Services Tax (CGST) is a tax on goods and services that is imposed by the federal government (CGST)

- The Products and Services Tax (GST) is a tax on goods and services levied by the state (SGST)

- The Union Territories’ Goods and Services Tax (UTGST) The Integrated Goods and Services Tax (IGST) is a combined goods and services tax (IGST).

Q- Is it possible to look up a GST number by name?

A- Companies and consumers can instantly validate any GSTIN with the GSTIN Number Search by Name tool. All a user has to do is key in the name of the company entity, and the data will show immediately.

Q- What is the procedure for obtaining my first GST certificate?

A- To get started, go to the GST Portal and create an account. Select ‘Services’ from the drop-down menu. ‘User Services’ > ‘User Services’ > ‘User Services’ ‘User Services’ > ‘User Services’ > ‘User Services’ ‘User Services’ > ‘User Services’ > ‘User Services’ > ‘User Services’ is a term that refers to a group of people who You can either view or download the certificate. From the drop-down option, choose ‘Download.’ Take a printout of the PDF file you just downloaded.

Q- How is GST calculated?

A- The Goods and Services Tax (GST) is a single domestic indirect tax law that applies across the board. The GST is levied at every point of sale under the new law. The GST system imposes a levy at every point of sale. When it comes to intra-state commerce, both the states and the federal government are responsible for collecting GST. All interstate sales are subject to the Integrated GST.

![How to Convert MP3 to MP4 with Images Easily? [Free] - 14 How to Convert MP3 to MP4](https://techmodena.com/wp-content/uploads/2023/03/How-to-Convert-MP3-to-MP4-with-Images-Easily-Free-220x150.png)