Insurance policy: what it is, its characteristics, and how it works

What is an insurance policy? definition

An insurance policy is a contract between a natural person, an individual entrepreneur or a legal person (Policyholder) and an insurance company, which are linked by virtue of it and in which the obligations and duties of each of the parties are specified. (The terms and conditions to which both parties are subject, such as the scope and coverage of the insurance).

What is an insurance policy for?

This type of policy covers the insured for the risks provided for in the contract, that is, the possibility of the harmful event occurring and for which it is covered so as not to have to face a high expense at a certain time. All this occurs in exchange for a premium, which is normally paid on an annual basis.

Credit and surety insurance policies allow companies to insure the risk of non-payment, breach of contract, agreed claims, and other considerations, which are provided for in the Insurance Policy.

This makes it possible to operate in a much safer way and that the company can carry out its activity without worries, understanding that the points related to the collection and management of incidents of contracts or agreements are covered.

What are the differences between an insurance contract and an insurance policy?

The credit or surety insurance policy is the document in which the insurance contract is formalized, in which the rules, rights, duties, and obligations of the parties are specified.

The insurer, for its part, has the obligation to provide the insurance policy to the insured or, failing that, a provisional coverage document how do you take out an insurance policy?

An insurance policy is contracted with an insurance company, which offers a series of coverages to the insured accesses by paying a premium and whose price will vary depending on the amount of coverage or types of coverage.

Before contracting insurance, the insurance company sends an offer to the possible insured so that he can study it, and once an agreement is reached, the Policy will be formalized under the agreed conditions. Personal elements of an insurance policy

- Insured is the person who will be protected by the insurance, and may or may not be the same person who contracts it.

- The policyholder is the natural or legal person who signs the contract, whether insured or not, and who assumes the obligation to pay the premium and other obligations that correspond legally and contractually.

- The insurer is the company that will protect the insured and will take charge of the risk associated with the incident or cause.

- The beneficiary is the natural or legal person designated by the insured to collect the compensation derived from the accident.

Conditions and indications

The credit or surety insurance policy will contain, as a minimum, the following indications:

- Name and surname or company name of the contracting parties and their address, as well as the designation of the insured and beneficiary, if applicable.

- The concept in which it is secured.

- Nature of the risk covered, describing, in a clear and understandable way, the guarantees and coverage granted in the contract, as well as with respect to each of them, the rights, exclusions and limitations that affect them.

- Designation of the insured objects and their situation.

- Sum insured or scope of coverage.

- Premium amount, surcharges, and taxes.

- Maturity of the premiums, place, and form of payment.

- Duration of the contract with an expression of the day and time in which its effects begin and end.

- If a mediator is involved in the contract, the name, and type of mediator.

How to read an insurance policy?

More and more people realize the importance of having insurance that protects them against different eventualities. This is something positive for the development of the population: a protected society is a strong society.

Thanks to the offer and the growing information available, more and more people decide to insure their homes and cars or purchase a health or life policy. However, there is still a pending issue to be resolved: how to read the insurance policies we take out? Or, even better, how to read them before purchasing them?

We know how important it is to understand the most relevant aspects of insurance, such as these:

Insurance policy:

It is what we commonly understand as “insurance”. This is the contract that a user acquires with a company, through which a person or property is covered in the event of certain incidents. For example, comprehensive auto insurance addresses liability, accident damage, and vehicle theft, and even offers a relief car, among other things. The coverages and exclusions detailed in the policy can be clearly explained by the insurance agent.

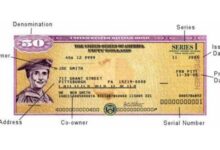

Policy cover :

A contractual document that specifies the data, the policy number, the contracted plan, the sums insured, and the validity of the policy, among other data. It is very important that you keep this document and have it on hand because it facilitates any complaint or process that you want to carry out with the insurer.

Premium :

Every month or every year an amount must be paid to be insured. This is called prime. Many people prefer to pay the premium annually, because the cost may be less. Others choose to spread that amount over several months, for greater convenience in payments.

Sum insured :

It is the maximum amount of money that is contemplated to pay for the incidents covered by the policy. If, for example, you have an illness or accident insurance, the maximum that the insurance will cover is the sum insured, which is indicated on the policy cover. This can vary according to the needs and desires of the client, but it is best to seek advice before making a decision. The higher the sum insured, the higher the premium that must be paid.

Deductible :

It is an amount of money that the insured must contribute in each event so that the insurance covers what was agreed. For example, if a car is insured, in case of theft the deductible is 5% of its value; the insurer will cover the rest. Some policies do not have a deductible. A higher deductible will lower the cost of the premium.

- How much does Adderall cost without insurance?

- Chase bank hours: Saturdays, Sundays, and Holidays [2023]

- How to withdraw pension contribution in EPF

- Importance of Preventive Care Coverage in Family Health Insurance | Chola MS

Coinsurance :

Depending on the type of policy you have, in some cases, you must provide an amount for coinsurance, which corresponds to a percentage of the total expenses generated by an event. For example, if you have health insurance and hospitalization is needed, part of the cost will be covered by the insured and the rest by the company. The coinsurance percentage is usually low.

The coinsurance differs from the deductible in that it depends on the expenses generated by a claim or incident, that is, it can vary from one event to another, while the deductible is a stable amount.

These brief explanations allow a better understanding of what is acquired when taking out new insurance, and also how to read the specifications of those that already exist. In any case, it is always advisable to approach a professional agent, who knows the products better than anyone and can help you choose the most suitable one.