Here is a simple guide to know about How to link or remove a Bank Account on PhonePe? PhonePe can be used to send and receive money, reload mobile phones, DTH, and data cards, and pay for utilities.

The company allows consumers to transfer money between bank accounts without providing any personal information such as bank account or IFSC code.

In addition, people can link two bank accounts in one app. To connect their bank accounts with PhonePe, customers must first complete a few procedures.

Website for e-commerce PhonePe, Flipkart’s UPI-based digital payment software, is widely utilized in India. It is a 24-hour, seven-day-a-week service that one can access at any time and from any location.

With the help of this software, anyone can send money from a bank account to anyone without providing any personal information.

How To link Or Remove A Bank Account On PhonePe?

How To Link A Bank Account On PhonePe?

- Step 1: Go to the My Money section of the website.

- Step 2: Under Payment Methods, choose bank accounts.

- Step 3: Select ‘Add New Bank Account’ from the drop-down menu.

- Step 4: Pick a bank.

- Step 5: It will retrieve all account information.

- Step 6: Create a UPI pin.

- Step 7: Type in the last six digits of ones Debit ATM card’s expiration date.

- Step8: To set up personal UPI pin, enter the OTP received.

- Step9: Ones bank account has been added, and users can now use their UPI pin to make a transaction directly from their bank account.

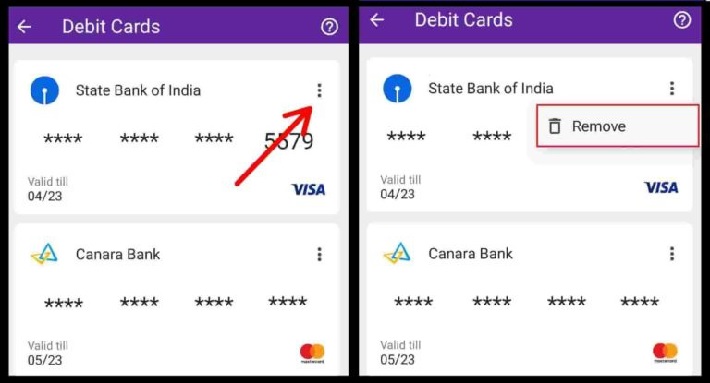

How To Remove Bank Account From PhonePe?

- Open the PhonePe application.

- Go to My Account to get started.

- Choose ones bank’s information.

- Select a certain bank.

- UNLINK Confirm It should be tapped.

- Ones PhonePe App has been updated to delete their preferred bank account.

How To Add Money To PhonePe Wallet Using Credit Card?

- Step 1: Launch the PhonePe application.

- Step 2: Select ‘My Money’ from the drop-down menu.

- Step 3: Choose ‘PhonePe Wallet’ from the drop-down menu. This can be found in the ‘Wallets/Gift Voucher’ section.

- Step 4: Enter the amount people would want to add.

- Step 5: Select the payment method (UPI, debit card, or credit card).

- Step 6: Finally, select ‘Topup Wallet’ and confirm the transaction.

How To Check Balance On PhonePe?

- To proceed, open the PhonePe app.

- Then select Money Transfer from the drop-down menu.

- After that, one must choose a bank.

- Then type in their UPI PIN.

- Their account balance will thereafter be shown.

People May Ask

What Happens If I Do Not Receive Any OTP While Making A Fund Transfer?

If you don’t receive an OTP, don’t try again right away; instead, wait a few minutes. It’s also possible that the problem is with your phone’s network. The problem can be resolved by waiting a few minutes and then attempting again.

Who Do I Contact If Money Has Been Deducted For Me But Has Not Been Credited For The Receiver?

Customer service can be reached at 080-68727374 or 022-68727374.

Why Am I Not Able To Transfer Funds?

If your account is depleted or the beneficiary’s bank server is overburdened, you may be unable to transfer payments.

Why Can’t I Link My Bank Account To PhonePe?

Adding a bank account to the PhonePe App is a simple procedure. However, we occasionally encounter the difficulty of being unable to add a bank account. It’s happening because you’ve used different PhonePe numbers to log in to the same app. Maybe you don’t have enough credit on your phone to send an SMS.

Is It Safe To Link Bank Account With PhonePe?

PhonePe is completely secure and safe. Yes, Bank is the driving force behind it. All transactions are processed over secure banking networks, and the app does not save any user information or passwords. Users just need to input one MPIN once for each transaction (which only know).

Is an ATM Card Necessary For PhonePe?

PhonePe, a UPI-based payment software introduced by Flipkart in India, allows users to make digital payments. By providing personal bank account information and obtaining a UPI ID, anyone can create a PhonePe account. Users must have a debit/ATM card in order to add a bank account and make payments.

How Many Bank Accounts Can We Add To PhonePe?

Users may effortlessly pay using PhonePe using only their mobile number. Users will be allowed to add two bank accounts to the same app.

Does PhonePe Need KYC?

No, new users are not required to complete KYC. However, in order to access the PhonePe wallet’s features, people must first complete a mini-KYC. Note that one will continue to get cashback into one’s wallet regardless of current KYC status. This balance can be used to make payments using the app.

How Do I Add UPI To A PhonePe?

On one phone, open the PhonePe app. Now, on the top left corner, tap on their profile. Then select My BHIM UPI ID from the drop-down menu. Select Add new BHIM UPI ID from the drop-down menu.

Read Also:

Conclusion

PhonePe allows users to transfer money between bank accounts without providing any personal information such as their bank account number or IFSC code.

Only the mobile number and virtual payment address of the individual to whom the payment is to be made are required for this method.

The software supports over 11 Indian languages and may be used to send and receive money, reload mobile phones, DTH, data cards, and pay for utilities.

One can also pay for things in stores, invest in tax-advantaged funds, liquid funds, buy insurance and mutual funds, and buy gold.

In addition, users can link two bank accounts in one app.

Very Informative, Thanks for sharing the valuable knowledge with us.

very informative