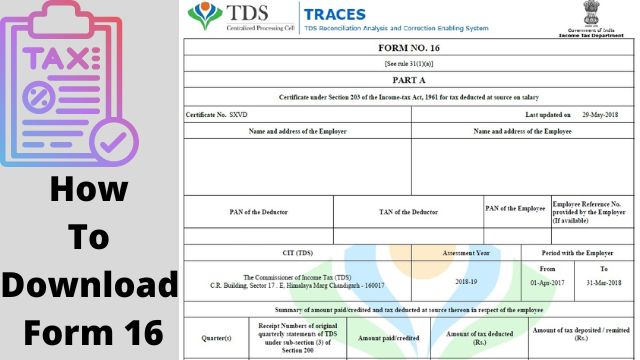

How To Download Form 16 For Income Tax Returns

- What is Form 16?

- Types of Form 16

- Difference between Form 16, Form 16A, and Form 16B

- How to Download Form 16?

How to download Form 16 for income tax returns? Employers in the country supply Form 16 to salaried employees. It comprises all of the information that the employee will need to file his or her income tax returns with the Indian Income Tax Department.

What is Form 16?

It is a document that provides all of the information needed to file tax returns. At the end of each fiscal year, companies must send Form 16 to their employees.

Types of Form 16

There are two types of Form-16:

- Form 16-A: This form summarizes the tax withheld by the employer or organization from the employee’s salary and deposited with the Internal Revenue Service. This form is being filled out on behalf of the employee.

- Part-B of Form 16-B is a consolidated statement that includes information such as the employee’s or employer’s salary, deductions (if any), and any additional income declared.

Different Parts of Form 16

The following are the two different parts :

- Part A

- Part B

Part A

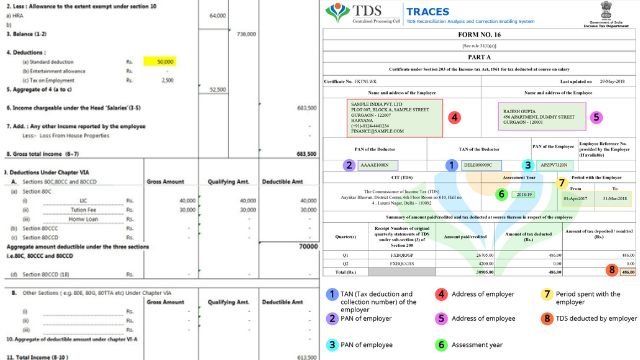

The employer must offer authentication before the certificate can be issued. If you change jobs, the new employer must also furnish you with a Form. It must be provided by each new employer. The following are the primary elements of Part A:

- Name and address of the employer

- PAN and TAN of the employer

- PAN of the employee

- On a quarterly basis, the amount of tax deducted and deposited

Part B

The following components are included in an annexure to the first portion, Part B:

- Separation of earnings (detailed)

- The exemptions under Section 10 of the Income Tax Act are broken down in detail.

- Any benefit under Section 89 of the Income Tax Act Deductions permitted under Chapter VI A of the Income Tax Act

Who is Eligible for Form 16?

It is available to everybody who earns a salary and is required to file tax returns. Individuals who do not need to file tax returns are not required to complete the Form. Employers, on the other hand, issue the certificate in order to keep track of their employees’ earnings.

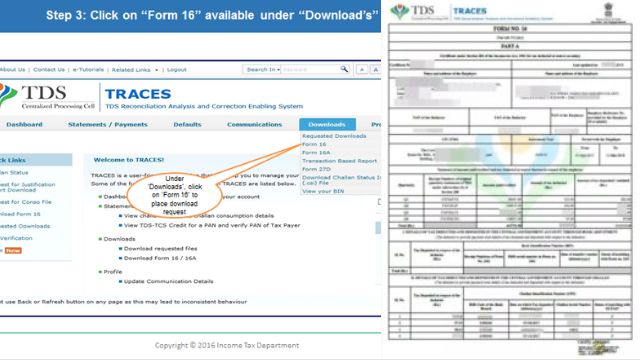

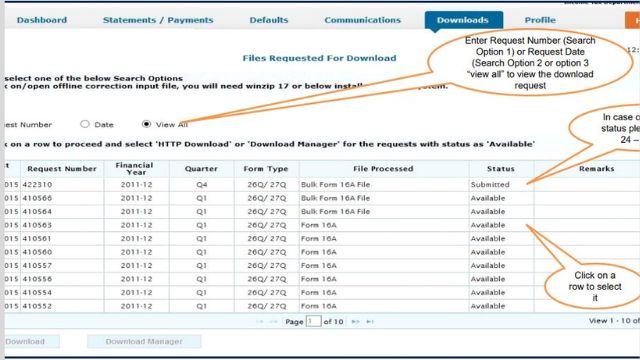

How to Download Form 16?

The following is the procedure for Form 16 download from the IRS’s official website. Steps for how to get from 16 online:

- Visit the Income Tax Department’s official website (https://www.incometaxindia.gov.in/Pages/default.aspx).

- The ‘Income Tax Forms’ option can be found under the ‘Forms/Download’ section; select it.

- The ‘PDF’ and ‘Fillable Form’ options are then available under ‘Form 16’.

- Select the appropriate option.

- On the following page, you will be able to download the form.

How to File ITR with Form 16?

When completing your ITR, you must provide specific pieces of information. It contains these specifics. The following are some of them:

- Section 10 of the Income Tax Act exempts certain expenses from being taxed.

- A breakdown of the deductions allowed under Section 16 of the Income Tax Act, as well as the income from home property that is subject to TDS.

- TDS was funded by income from other sources.

- A breakdown of deductions under Chapter VI-A of the Income Tax Act, including deductions under Sections 80C, 80CCC, Section 80CCD(1), Section 80CCD(1B), Section 80CCD(2), Section 80D, and Section 80E of the Income Tax Act. Aggregate of deductible amount under Chapter VI-A of the Income Tax Act, including deductions under Sections 10(a), Section 10(b), Section 10(c), Section 10(d), Section 10(e), Section 10

- Whether you owe a refund or owe a net tax.

Additional details from Form 16 income tax required for filing your income tax returns

- The employer deducts tax at the source.

- TAN of the employer

- PAN of the employer

- Name and address of the employer

- The year of assessment is now in progress

- The taxpayer’s name and address

- PAN (taxpayer identification number)

*At the bottom of the form, there are several fields that are marked for deductions. The list is as follows:

| Deductions | Contribution |

|---|---|

| Section 80C | PPF, Premium Payments Towards Life Insurance |

| Section 80CCC | PF |

| Section 80CCD(1) | Both salaried and self-employed towards NPS |

| Section 80CCD(1B) | Additional Deduction towards the Pension Scheme |

| Section 80CCD(2) | Employer’s Contribution to Pension Scheme |

| Section 80D | Health insurance |

| Section 80E | Education Loan |

| Section 80G | Donations or Charitable Trusts |

| Section 80TTA | Savings Account |

Why Form 16 is needed?

For the following reasons, It is an important document:

- It serves as documentation that your company has deducted and deposited your tax with the government.

- It aids in the electronic filing of tax returns.

- When you approach a bank or financial institution for a loan, they will normally ask for it.

Have you misplaced your Form 16? Here’s what you can do about it.

It is a vital document that must be kept in good condition. If you’ve misplaced your Form, you can look through your mail to find it (if you received it via mail). If you received a hard copy from your company and misplaced it, you can ask for a replacement form.

How to calculate your salary income if you have not received Form 16 from your employer?

Employers sometimes fail to give Form to employees whose yearly pay is less than the taxable threshold (Rs.2.5 lakh).

If you don’t have Form, you’ll need to use your bank statements, pay stubs, home loan or education loan certificates, tax-saving investment evidence, Form 26AS, and other documents to file your income tax returns.

Read Also:

- How to pay taxes using a credit card

- How To Download Contacts From Google Account

- How To File Income Tax Return, FY 2021-22 (AY 2022-23)

Your paystubs will show your basic salary and allowances, while Form 26AS will show all of the taxes you’ve paid and those that have been deducted.

In the event that you do not receive the Form, here is an example of how tax is calculated:

- Monthly Basic Pay: Rs.30,000 (Rs.3.60 lakh per year)

- Monthly transportation allowance: Rs.1,400 (16,800 per year)

- Rs.30,000 in deductions

- There will be no tax due on the allowance because a tax exemption of Rs.1,600 per month is given.

- (Rs.3,60,000 – Rs.40,000) is the taxable amount. – 2,50,000 rupees = 70,000 rupees

What are the benefits of Form 16?

The following are some of the form 16 India advantages:

- It serves as the individual’s “income from salary” declaration.

- It aids in the preparation of income tax returns.

- It is a document that is used to support the issuance of a visa.

- It serves as proof of earnings.

- It assists you in keeping track of all of your tax-saving investments.

- It gives you a clear view of how your taxes were calculated, paid, and refunded.

Difference between Form 16, Form 16A, and Form 16B

The following table summarizes the differences between Form 16, Form 16A, and Form 16B:

| Form 16 | Form 16A | Form 16B |

| 1) The employer is the one who deducts the TDS. | 1) Issued by a financial institution that does not deduct TDS. | 1) Issued by the buyer to the seller for the purpose of deducting TDS on the sale of immovable property. |

| 2) Issued for payroll taxes deducted at source. | 2) For any other income other than pay, issued for tax deducted at source. | 2) For the sale of immovable property, issued for tax deducted at source. |

Conclusion

Although Form 16 is not required to be attached as a supporting document when filing income tax returns, it must be kept for a minimum of 6 years from the end of the relevant assessment year. As a result, be sure that the Form is not thrown out with other unnecessary items during the holiday cleaning frenzy.

Disclaimer

Trademarks, tradenames, logos, and other intellectual property subject matters displayed on this site are the property of their respective intellectual property owners. The display of such IP along with relevant product information does not imply that Techmodena is affiliated with the Intellectual Property owner or the issuer/manufacturer of such items.

Q- What is the process for creating Form 16?

A- The TDS CPC is in charge of generating Form based on the processing of quarterly TDS and TCS statements. On the TRACES website, a deductor will be needed to submit a request for the same.

Q- What are the deadlines for submitting Form 16 and Form 16A certificates?

A- It is issued once a year and is due by May 31st. Form 16A, on the other hand, is issued quarterly and is due 15 days after the due date for filing the statement of tax deducted at source as required by Rule 31A.

Q- If I misplace my original Form certificate, can I acquire a duplicate?

A- Yes, you must contact your deductor in order to obtain a duplicate certificate.

Q- Who will issue my Form 16 if I am a retiree?

A- If you are a pensioner, It will be issued by the bank where you get your pension. In this instance, your previous employer will not be issuing the Form.

Q- Is it possible to obtain a copy of my Form certificate without first registering on the TRACES website?

A- To download your Form 16 and Form 16A, you must be a registered user on the TRACES website.